How to Calculate Depreciation with Microsoft Excel SLN, SYD, DDB Functions in Easy Way [Full Tutorials]

Depreciation:

In this tutorial, we will discuss, How to Calculate Depreciation with Microsoft Excel SLN, SYD, DDB Functions in Excel. Excel Provide five (05) different function to calculate depreciation expense. Let’s start with what is depreciation. How to Calculate Depreciation In Excel SLN SYD DDB Functions

How to Calculate Depreciation In Excel SLN SYD DDB Functions

Author Writer: Arshad Sultan [ Expert ]

Author Uploaded: Arshad Sultan

Download Official Link:

[ https://products.office.com/en-us/microsoft-excel-2007 ]

What Is Depreciation?

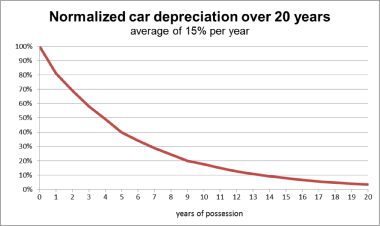

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible.

An example of fixed assets are buildings, furniture, office equipment, machinery etc.. A land is the only exception which cannot be depreciated as the value of land appreciates with time.

How to Calculate Depreciation In Excel SLN SYD DDB Functions

Microsoft Excel Depreciation Functions.

Microsoft Excel Provide five (05) different function to calculate depreciation expense as follow:

- SLN Function: Returns the straight-line depreciation of an asset for one period.

- SYD Function: Returns the sum-of-years’ digits depreciation of an asset for a specified period.

- DB Function: Returns the depreciation of an asset for a specified period using the fixed-declining balance method.

- DDB Function: Returns the depreciation of an asset for a specified period using the double-declining balance method or some other method you specify.

- VDB Function: Returns the depreciation of an asset for any period you specify, including partial periods, using the double-declining balance method or some other method you specify. VDB stands for variable declining balance.

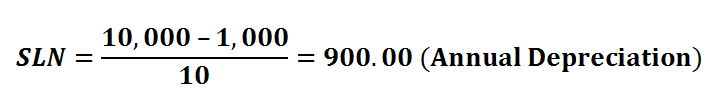

SLN Function

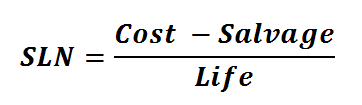

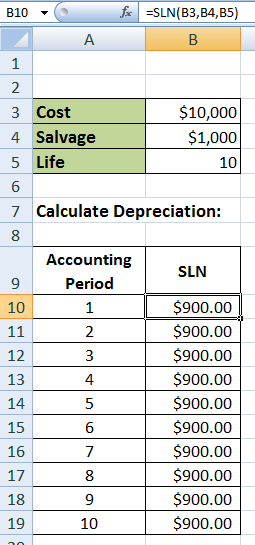

Returns the straight-line depreciation of an asset for one period. SLN Function is very simple and easy function, calculate the same every year.

Syntax:

SLN(cost,salvage,life)

Define Function Arguments.

Cost is the initial cost of the current asset.

Salvage is the value at the end of the depreciation.

Life is the number of periods over which the asset is depreciated.

Example:

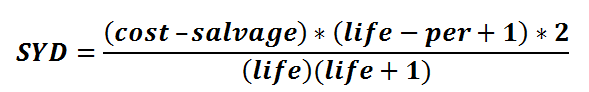

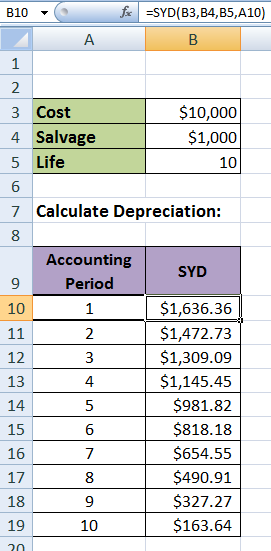

SYD Function

Returns the sum-of-years’ digits depreciation of an asset for a specified period.

Syntax:

SYD(cost,salvage,life,per)

Define Function Arguments.

Cost is the initial cost of the current asset.

Salvage is the value at the end of the depreciation.

Life is the number of periods over which the asset is depreciated.

Per is the period and must use the same units as life.

Example:

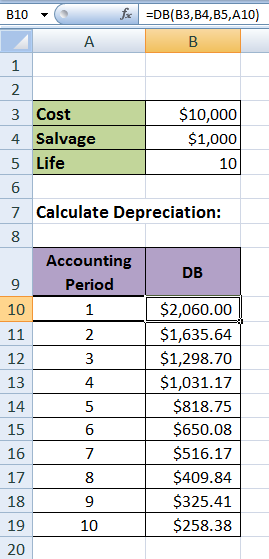

DB Function

Returns the depreciation of an asset for a specified period using the fixed-declining balance method.

Syntax:

DB(cost,salvage,life,period,month)

Cost is the initial cost of the asset.

Salvage is the value at the end of the depreciation (sometimes called the salvage value of the asset).

Life is the number of periods over which the asset is being depreciated (sometimes called the useful life of the asset).

Period is the period for which you want to calculate the depreciation. Period must use the same units as life.

Month is the number of months in the first year. If month is omitted, it is assumed to be 12.

Example: